In 2018, the Supreme Court overruled the previous ruling that states can only require sellers to collect tax when they have a physical presence in the state. Now, states can require tax collection responsibilities on sellers who have an economic presence without a physical presence.

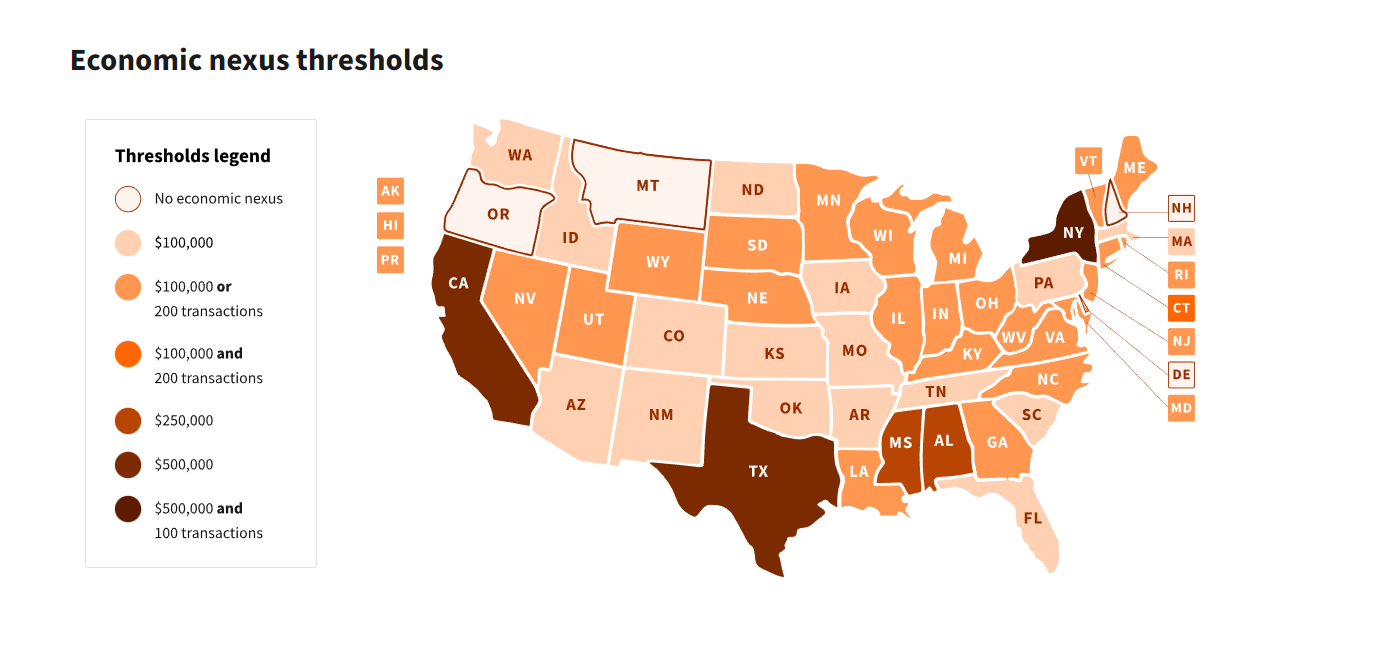

Many online retailers sell products all over the United States. Out of state sales without a physical presence can still trigger tax obligations in other states. Most states have economic nexus which is a threshold set by the state requiring the out of state seller to collect and remit sales tax. Economic nexus is triggered by reaching a certain amount of sales and/or number of sales transactions in another state.

If you reach any of the nexus thresholds, you must collect and remit sales tax in those states. If you do not reach the nexus threshold, you will collect and remit sales tax in the state your business is located in.

Disclaimer: The information provided above is not meant to be legal or tax advise. You should consult your CPA and attorney to determine the best course of action for your situation.

Mitzi E. Sullivan, CPA is a cloud based professional services provider specializing in cloud accounting.