What is the date?

The deadline for contributing to a Roth IRA for a given tax year is the same as the deadline for filing your tax return for that year. For example, if you want to make a contribution for the 2022 tax year, you must do so by the tax filing/extension deadline of April 18, 2023.

What if I’m late?

If you request an extension to file your tax return, the deadline for making a Roth IRA contribution for that year is extended to the extension deadline, which is typically October 15 of the following year. It’s important to note that you cannot make contributions for past years, and that you must have earned income for the year in which you are contributing to a Roth IRA.

What exactly is a Roth IRA?

A Roth IRA is a type of individual retirement account (IRA) that allows individuals to save for retirement with after-tax dollars. Unlike traditional IRAs, which allow individuals to deduct contributions from their taxable income, Roth IRA contributions are not tax-deductible. However, withdrawals from a Roth IRA are tax-free, as long as they are qualified distributions.

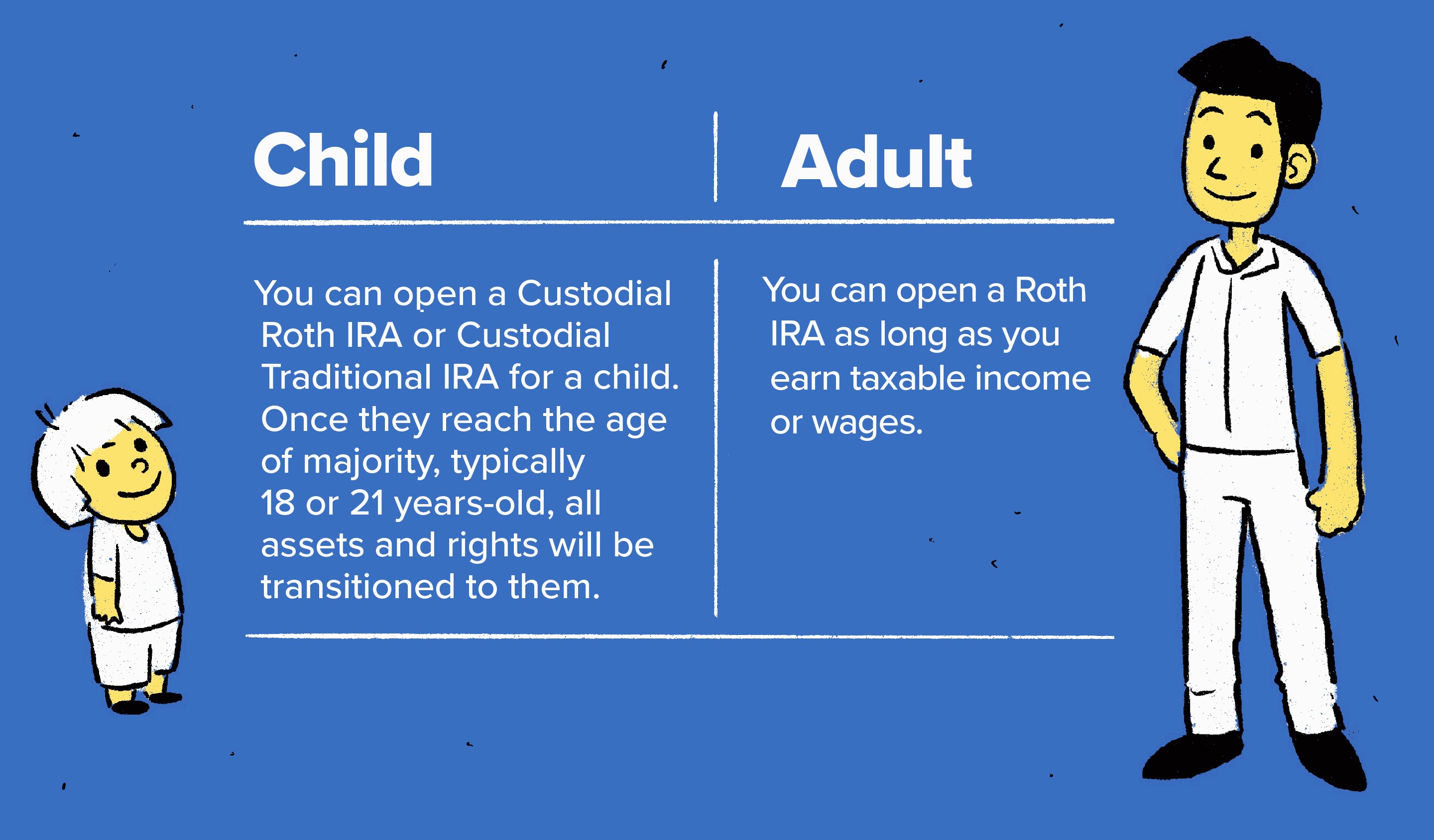

Who is eligible?

To be eligible to contribute to a Roth IRA, you must have earned income and your income must be below certain limits. As of 2023, the maximum contribution limit for a Roth IRA is $6,000 per year for individuals under age 50, and $7,000 for those age 50 or older.

What are reasons for having a Roth IRA?

One of the main benefits of a Roth IRA is that it allows for tax-free growth and withdrawals, which can be particularly advantageous for individuals who expect to be in a higher tax bracket during retirement. Additionally, there are no required minimum distributions (RMDs) for Roth IRAs, which means you can leave your money invested for as long as you like without being forced to take withdrawals.

Disclaimer: The information provided above is not meant to

be legal or tax advise. You should consult your CPA and attorney to

determine the best course of action for your situation.

Mitzi E. Sullivan, CPA is a cloud based professional services provider

specializing in cloud accounting.